By Rita Ouimet, Project Coordinator, Healthy Food Financing Initiative

According to the USDA, 34 million Americans suffer from food insecurity and poor grocery access in the United States. However, nearly 20% of Black Americans reside in households grappling with food insecurity, a rate almost double the national average of 10.2%. Moreover, they are three times as likely to experience food insecurity compared to their white counterparts (Coleman-Jensen et al., 2021). In the United States, 81% of Black Americans live in urban or suburban communities, which indicates that levels of food insecurity are higher in those areas (Cox, 2022).

But why are Black urban neighborhoods subject to high levels of inadequate grocery access? The answer is both simple and complicated; while many factors compounded over time to bring about the kind of disinvestment we still see today, lack of supermarket access in urban areas can be traced back to race- and class-based discriminatory government policies. It was home lending practices that laid the foundation for the pervasive economic inequalities that deeply affected America’s food landscape.

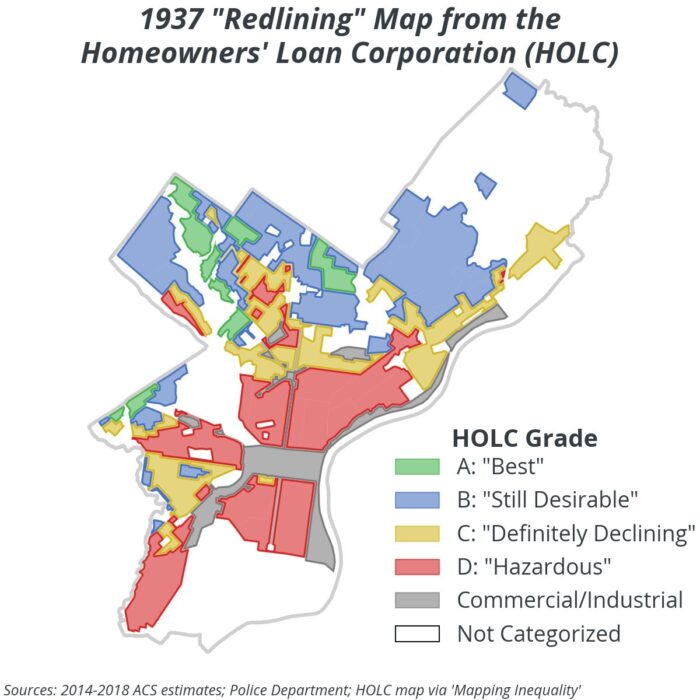

In the early 1930s, the federal government created the Home Owners’ Loan Corporation (HOLC) in response to the Great Depression with the intent to prevent home foreclosures across the country. HOLC purchased at-risk mortgages and offered them back to homeowners with 10 to 20 year extensions and lower interest rates. Given that this was a significant federal government investment, HOLC needed to establish a system for identifying areas where residents were most likely to be able to repay loans. The agency considered several neighborhood characteristics, like access to public transportation and the quality of the homes, but they gave the most weight to racial-ethnic compositions (Meisenhelter, 2018). HOLC created color-coded maps that determined “risky” versus “safe” neighborhoods to engage with, based on racist assumptions about who lived in these areas and their ability to repay loans, regardless of income level. This is now known as the practice of “redlining.” The agency created a map for every major metropolitan area in the US that outlined lending recommendations with 4 different designations: “Best,” “Still Desirable,” “Definitely Declining,” and “Hazardous” (Rothstein, 2017). The more industrial urban areas, where low-income and people of color made up most of the population, were almost always deemed “Hazardous.”

Redlined maps were used for decades by private and public banking institutions to determine areas to invest in and areas to avoid. It’s important to note that redlining was primarily created on the basis of race; a middle-class Black neighborhood was still designated as “Hazardous” to lenders even if residents were in good economic standing. Therefore communities of color, primarily Black neighborhoods, were legally and strategically prohibited from obtaining affordable mortgages.

Over time, the impacts of unaffordable mortgages compounded. For decades, while other communities were given the opportunity to purchase or preserve their homes at lower interest rates, residents in “hazardous” areas struggled to meet monthly payments — taking on second jobs and living in overcrowded homes as a way to cut costs. Under these adverse economic circumstances, home maintenance became unaffordable in these distressed communities, which perpetuated the stereotype that neighborhoods of color were naturally riskier lending areas (Rothstein, 2017).

Other policies contributed to the disinvestment in poor Black communities. In 1934, the Federal Housing Administration (FHA) was created to back lines of credit to buyers as another way to support homeownership and boost the national economy during the Great Depression. However, the FHA only supported homeownership for white Americans. For decades the agency “discouraged banks from making any loans at all in urban neighborhoods,” (Rothstein 2017) which were primarily neighborhoods of color, and encouraged white residents to move to the newly developing suburbs. Further, after World War II, all returning veterans were supposed to be guaranteed homeownership by the Department of Veteran Affairs and the FHA. In practice, however, only white veterans were afforded this benefit. Veterans of color or people interested in buying homes in urban areas were unable to do so because the FHA would either not provide assistance or instead offer loans with prohibitive, astronomical interest rates (Rothstein 2017).

What do historical home lending practices have to do with supermarkets?

These discriminatory lending practices in homeownership not only created segregated communities, but reinforced those that already existed. As white residents were able to purchase homes in the rapidly expanding suburbs, the property tax base for urban areas decreased and inner-city conditions deteriorated. Over the next few years, more policies and practices, such as the establishment of industrial and manufacturing zones in proximity to already disadvantaged communities, perpetuated neighborhood blight and furthered racial isolation (Rothstein 2017).

The deterioration of the quality of life for the urban poor and residents of color led to widespread disinvestment, which is the reluctance or reversal of developers to invest in certain areas. The disinvestment in urban supermarkets started with suburbanization. White, affluent residents, encouraged by federal policies, relocated to the suburbs, taking with them the resources they had historically enjoyed (Eisenhaur, 2011).

Private investment caters to those who can afford it, so large grocery stores, who had already been putting smaller stores out of business, left urban neighborhoods and relocated to the suburbs (Eisenhaur, 2002). From the 1950s to the 1970s, big box stores’ presence in suburbia grew exponentially, and by the 1980s, supermarkets were closing their doors in cities. For example, between 1978 and 1984, Safeway closed 600 stores in urban areas, claiming these locations were subject to high labor and utility costs, theft, and low profit margins (Eisenhaur, 2002). Apprehension to open new grocery stores in urban areas spread throughout the industry.

Today, “when comparing communities with similar poverty rates, Black and Latino neighborhoods tend to have fewer supermarkets that offer a variety of produce and healthy foods, and have more small retail (i.e., convenience and liquor) stores that have fewer produce options than in predominantly white neighborhoods” (Eisenhaur, 2002).

According to a study conducted by Bruce Mitchell and published by the National Community Reinvestment Coalition in 2018, racial and economic segregation brought about by redlining in the 1930s still permeate American cities today. The study shows that 64% of neighborhoods of color are still in areas that were labeled “hazardous” by the HOLC and 74% are low-income. By comparison, 91% of neighborhoods that were labeled “best” are upper-income, and “almost entirely white” (Meisenhelter, 2018).

“The study shows how policies that influence access to capital and credit can have a lasting impact on housing patterns, the economic health of neighborhoods, and who accumulates wealth – for decades. That means new policies to boost access to capital, including in low- and moderate-income communities can also have a lasting impact” (Meisenhelter, 2018).

The Role of HFFIs: Reinvesting in Communities

Healthy Food Financing Initiatives, or HFFIs, are grant and loan programs that support healthy food retail development and preservation in under-resourced areas by funding projects across the food system like grocery stores, corner stores, distributors, mobile markets and farmers markets. Typically, funded entities must be located in a low-income area that otherwise does not have healthy, affordable or culturally relevant foods already available. Funding for these programs can come from many different sources, but is commonly the result of partnerships between public and private organizations.

The First HFFI

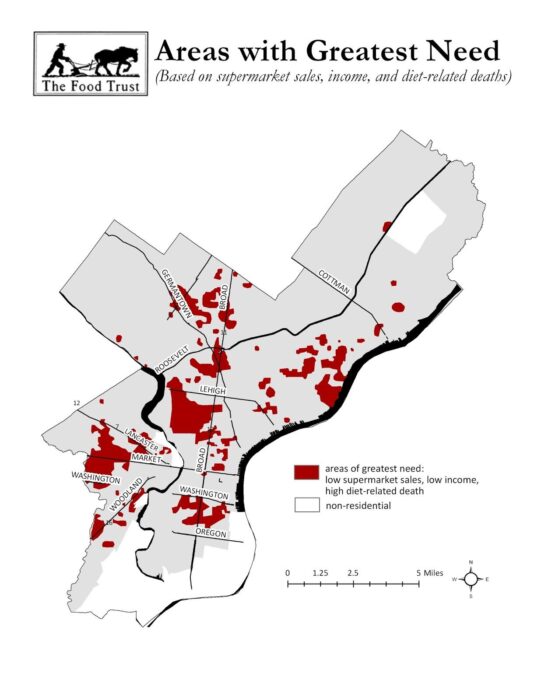

The first HFFI began with The Food Trust in the early 2000s after hearing concerns from Philadelphia residents about not having year-round access to fresh produce in their low-income neighborhoods. Since this was not an issue that was being addressed by policymakers at the time, in 2001 The Food Trust published Food For Every Child: The Need for More Supermarkets in Philadelphia, a report which mapped which areas around Philadelphia were affected by low supermarket access, low incomes, and high rates of diet-related deaths.

The map resonated with Philadelphia City Council, who asked The Food Trust to convene a task force, the Food Marketing Task Force, to come up with solutions. The Food Trust brought together representatives from the civic sector, public health, economic development, city government, and even grocery stores to best understand the challenges to investing in these underserved communities. After one year, the task force presented City Council with 10 recommendations for increasing supermarket investment across the city. One recommendation was the Pennsylvania Fresh Food Financing Initiative, the first HFFI in the country. The state then adopted the program in 2004; the first iteration ran from 2004-2010 and had $30 million in funding. The program was recapitalized in 2018 and continues to this day with management by The Food Trust.

If one thing is clear, it’s that programs that promote investment in historically redlined neighborhoods are one way to help bridge the racial wealth gap that has been perpetuated by discriminatory lending policies. And if one solution is obvious, it’s HFFIs. By directly funding stores in low-income areas without existing grocery access, two indicators of historical redlining, HFFIs not only provide financial capital to businesses in areas that have been excluded, but help create and retain quality jobs, reduce tax leakage and encourage further investment into that community. In addition, many HFFIs place an emphasis on community-informed project development. Supporting stores that are connected to and supported by their communities helps ensure the long-term sustainability of both the store and the neighborhood’s access to fresh and affordable foods.

Today, there are two federal iterations of the Pennsylvania Fresh Food Financing Initiative and more than 20 HFFIs operated by individual states. Since 2018, the PA FFFI has granted out over $2.8 million to 70 grocery stores and other food retailers and leveraged over $38 million in funds to support these projects. Over 1,600 jobs have been created and retained, and funded projects have reached almost 1 million residents. The program provides grants, loans and funding for business assistance to eligible projects; most projects can qualify for up to $50,000 in grant funds, and high-impact projects can qualify for up to $150,000. If interested in a loan, applicants are connected to a Community Development Financial Institution (CDFI) in their area. Funding for the HFFI administered by the Food Trust, the Pennsylvania Fresh Food Financing Initiative, comes from the state’s Department of Community and Economic Development.

Information on upcoming funding rounds and eligibility criteria for the PA FFFI can be found here. Applications are encouraged from grocers and other healthy food retailers in economically depressed areas of Pennsylvania that lack adequate food access.

Sources:

Eisenhaur, E. (2002). In Poor Health: Supermarket Redlining and Urban Nutrition (pp. 125–133). Kluwer Academic Publishers.

Rothstein, R. (2017). The Color of Law: A Forgotten History of How Our Government Segregated America. Liveright Publishing Corporation.

Meisenhelter, J. (2021, September 23). How 1930s Discrimination Shaped Inequality in Today’s Cities. NCRC. https://ncrc.org/how-1930s-discrimination-shaped-inequality-in-todays-cities/

Coleman-Jensen, A. (2022). Household Food Security in the United States in 2021. U.S. Department of Agriculture Economic Research Service. https://www.ers.usda.gov/webdocs/publications/104656/err-309.pdf?v=6952.4

Greenwood, S. (2023, May 1). Black Americans’ Identity and Connection to Community | Pew Research Center Pew Research Center Race & Ethnicity. https://www.pewresearch.org/race-ethnicity/2022/04/14/black-americans-place-and-community/#:~:text=Roughly%20equal%20shares%20of%20Black,new%20Pew%20Research%20Center%20survey